Current Investments

NHI Mechanical Motion Group

Makers Forward, LLC partnered with management and acquired NHI Mechanical Motion LLC in December 2019. Since then, the company has grown NHI with existing and new customers as well as launched two new business both Terre Products and Mantis Conveyor Products.

NHI Mechanical Motion, LLC

www.nhi-mfg.com

Founded in 1960, is one of the largest U.S. manufacturers and distributors of mechanical motion parts and assemblies, serving the outdoor power equipment, power transmission, material handling, farm & agriculture, and elevator markets, among others. NHI is an ISO 9001:2015 quality certified American manufacturer, based in Claremont, NH, with global supply chain management and distribution capabilities. The Company offers in-house product design, research & development, testing and process engineering services to support high-quality parts production and assembly with a focus on continuous cost improvement. Specific manufacturing capabilities include metal stamping, injection molding, machining, split forming, and assembly. The Company also has extensive distribution capabilities and significant capacity for additional growth in its new 140,000 sq ft facility.

NHI is trusted by many of the largest OEM’s in target markets including Stanley Black & Decker / MTD Products (Cub Cadet, Troy-Bilt), Toro, John Deere, Briggs & Stratton, Gates, Generac, Husqvarna, Mitsubishi Caterpillar, and Tuff Torq.

Terre Products

www.terre-products.com

Terre Products, formerly Phoenix Distribution, is a source for genuine, affordable replacement parts and general-purpose mechanical motion parts and outdoor power equipment. Terre supplies products to large retailers such as Tractor Supply, Northern Tool, and Rural King. Terre also sells direct to consumers through e-commerce channels such as Amazon.com, Walmart.com, and its own web site. Terre is a high-growth business that has successfully leveraged the manufacturing, sourcing, warehousing, inventory management systems, engineering, and sales capabilities.

Mantis Conveyor Products

www.mantis-mfg.com

Mantis Conveyor Products offers CEMA-rated idlers, trough assemblies, return rollers, pulleys, and other conveyor rollers and components with superior durability for the aggregates industry’s toughest conveyor equipment and applications. With it’s patented idler design and durable, lighter weight troughing assemblies, Mantis delivers more uptime and less maintenance with products that are built to last.

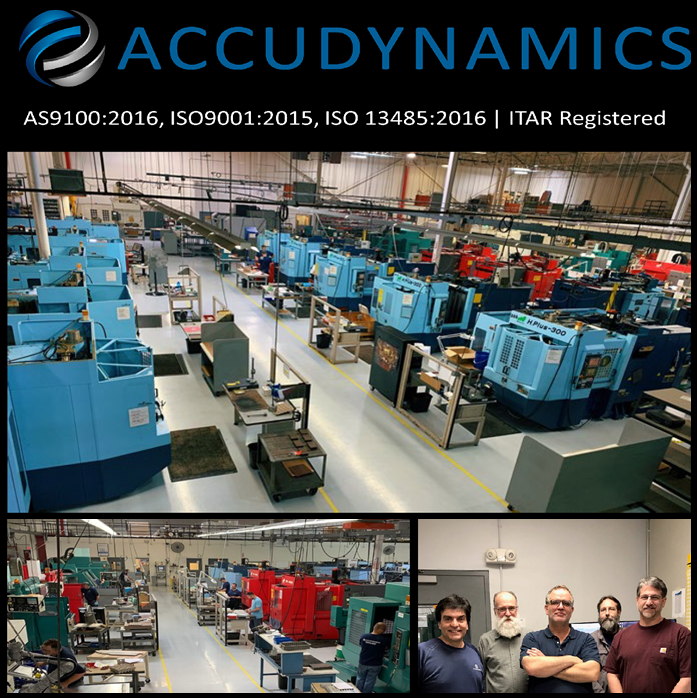

Accudynamics Group

Makers Forward LLC followed a familiar path of partnering with management to acquire Accudynamics from Aragra Corporation in January 2021. Accudynamics serves as the platform and model for subsequent acquisitions as part of Accu Group listed below – including DCG Precision Manufacturing, Star Glo Precision, and TAM Metal Products.

Accudynamics, LLC

www.accudynamics.com

Accudynamics is a custom component manufacturer for several industries with a particular specialty in the medical diagnostics equipment market. Founded in 1984, the business has grown over three decades into a highly respected manufacturer of machined products and assemblies. The design for manufacturing engineering team has extensive experience and successes helping customers meet difficult design and quality requirements and then focusing on improving costs during production life cycles. The operations and assembly teams follow strict quality control protocols and utilize advanced CMM equipment throughout the facility to ensure performance.

Accudynamics is a trusted supplier to many globally respected brands such as Siemens, Abbott, Beckman Coulter, and many others. Located in Lakeville, Massachusetts, Accudynamics is growing its business through expanding its existing customers as well as earning business with new customers in various industries.

DCG Precision Manufacturing, LLC

www.dcgprecision.com

DCG Precision Manufacturing was founded in 1943 as a centerless grinding service provider in Danbury, CT. After decades of growth and expansion, DCG developed into a leading supplier of precision machined components and assemblies to many of the nation’s premier manufacturers in the medical, aerospace, defense, and industrial markets. Now located to Bethel, Connecticut, and operating in a 37,000 engineering and manufacturing facility, the ISO 9001 and AS9100 certified business operates a six-day and two-shift operation with the capacity to grow. DCG’s focus on process improvement, cost-reduction programming, and exceptional quality has been the engine that drives the business. DCG provides superior service and quality to several large US brands including Collins Aerospace, US Surgical, Medtronic, Honeywell, and several other market leading companies.

DCG was acquired in a partnership with management and Accudynamics in September 2022.

Star Glo Precision, LLC

www.starglo.com

Star Glo Precision, LLC, was formed to acquire the metal machining assets of Star Glo Industries. Star Glo, founded in 1950, established itself as a premier provider of Swiss screw machining services, specializing in manufacturing high-quality custom components for aerospace, defense, government, and medical industries. Operating from its facility in Carlstadt, New Jersey, Star Glo has built its reputation through dedicated service, quality workmanship, and state-of-the-art CNC Swiss machining capabilities.

In April 2023, Star Glo's metal products division was acquired in a partnership with management, and Makers Forward portfolio companies Accudynamics and DCG Precision. Star Glo strengthens their collective manufacturing capabilities and expanding their service offerings. The integration combines Star Glo's highly efficient Swiss machining expertise with Accudynamics' engineering resources and DCG Precision Manufacturing's capabilities, creating enhanced value for customers across all three operations while maintaining the trusted Star Glo name and commitment to premium quality. Star Glo services many industries including sporting goods, aerospace, defense, industrial, and others.

TAM Metal Products / TAM Precision, LLC

www.tam-ind.com

TAM Metal Products (TAM Precision, LLC), established in 1958 in Mahwah, New Jersey, is a leading supplier of premium quality sheet metal enclosures, precision components, and assemblies serving premier manufacturers in aerospace, defense, medical, and commercial industries. TAM serves some of the leading companies in North America including, BAE Aerospace, Honeywell, L3Harris, Lockheed Martin, Lucent Technologies, Stryker, Northrup Grumman and several others. Operating from a 55,000 square foot ISO 9001/AS9100 certified facility with NADCAP Certification for welding and plating, TAM has earned recognition as a Certified Supplier to numerous International Aerospace, Defense, and Telecommunication Corporations through its commitment to quality assurance and dock-to-stock programs.

On September 2024, TAM Metal Products was acquired by Makers Forward, LLC and became part of the Accudynamics Group of companies. This strategic acquisition combines TAM's extensive sheet metal and precision manufacturing capabilities with Accudynamics Groups' world-class engineering team and resources, while maintaining TAM's existing management and workforce. Integration will enhance the combined companies' ability to serve customers across all operations, leveraging nearly 65 years of TAM's manufacturing excellence with Accudynamics' comprehensive manufacturing solutions portfolio.

Previous Investments

PowerShot Tool Company, Inc.

PowerShot Tool Company, Inc (PST) was formed by a partnership between Makers Forward partners and Longwood Industries, Inc to acquire the consumer fastening business from Black & Decker. PowerShot become a top manufacturer and marketer of hand tool products such as staple guns, glue guns, rivet tools and accessories, to the major retail and professional contracting markets. The company assembled a top-notch management team that demonstrated dramatic growth in sales and profitability, achieving over 50% compound average growth rate top line and 60% CAGR in EBITDA.

The company successfully separated the operations from a Black & Decker facility while relocating and upgrading manufacturing technology into a new PST operation in Wytheville, Virginia. PST established distribution with the leading retailers including; Home Depot, Lowe’s, Sears, Ace Hardware, Canadian Tire, and several others, as well as being name a ‘vendor of the year’ at a leading retailer. During its five-year ownership the company increased productivity in manufacturing by more than 240% and output by more than 500%. The shareholders experienced an internal rate of returns (IRR) on the investment of more than 100%.

IDL TechniEdge, LLC

IDL TechniEdge, LLC was formed to acquire the assets of TechniEdge Manufacturing and Cardan Medical. Makers Forward partners, the selling family, and management partnered to re-establish TechniEdge as a leading blade manufacturer and marketer in North America. TechniEdge grew to become the largest US based manufacturer of several blade types, including single edge, hobby, chopper, mat and others. During its ownership TechniEdge more than tripled revenues and turned a money losing operation into a highly profitable enterprise.

The company successfully consolidated two manufacturing sites into a single larger operation in Kenilworth, New Jersey and invested in cutting edge manufacturing technologies to more than quadruple capacity and dramatically improving efficiency. TechniEdge partnered with major retail and OEM partners including Home Depot, Ace Hardware, TrueValue, Menards, Stanley, Milwaukee, Irwin, Lenox, X-Acto and many others to significantly increase market share. IDL TechniEdge, LLC investors returned more than a 4.5X return on the investment.

Investment Profile

North American based operations, generally with the following parameters:

Business type:

Manufacturing businesses

Home improvement

Machinery & Equipment

Consumer or Industrial durables

Business background:

Distressed Companies

Corporate Divestitures

Ownership transition or retirement

Various structures utilized

Business Size:

Revenue preference $25 to $125 million

Consider $10 to $200 million

EBITDA preference 0.1% to 10%

Consider up to 15%